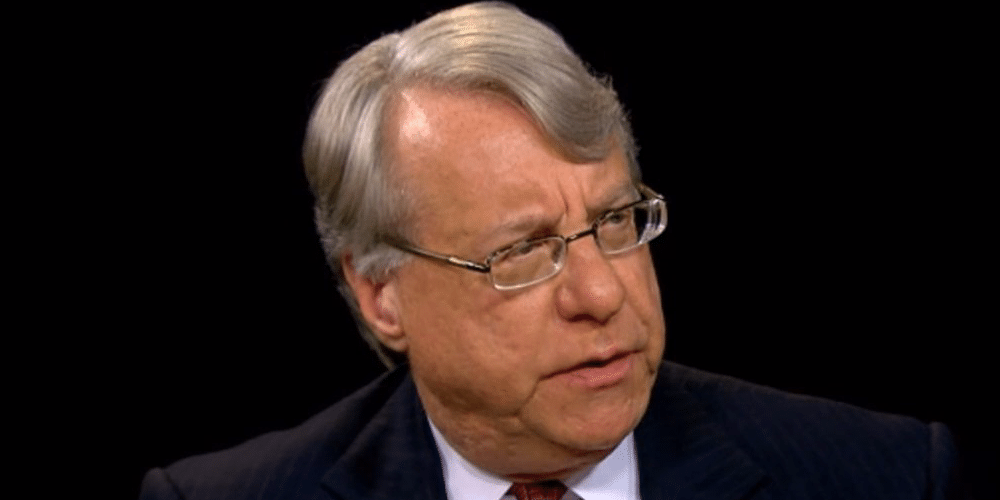

Jim Chanos Net Worth: The Inside Story Of The Iconic Short-Seller

Jim Chanos, one of the most influential short-sellers in the financial world, has built an impressive career exposing corporate fraud and navigating market complexities. His ability to identify overvalued companies and predict market downturns has earned him a reputation as a financial visionary. In this article, we will explore the life, career, and net worth of Jim Chanos, uncovering the secrets behind his success.

As the founder of Kynikos Associates, Chanos has been at the forefront of short-selling for decades, amassing a significant fortune through his expertise in identifying undervalued stocks. His career is a testament to the power of skepticism and rigorous analysis in the financial markets.

In this article, we will delve into Chanos's journey, examining his early years, professional milestones, and the factors contributing to his net worth. Whether you're an aspiring investor or simply curious about the world of finance, this article will provide valuable insights into the life of one of Wall Street's most respected figures.

Read also:9x Flix The Ultimate Guide To Streaming Movies And Tv Shows

Table of Contents

- Biography of Jim Chanos

- Early Life and Education

- Career Highlights

- Jim Chanos Net Worth

- Investment Strategy

- Notable Achievements

- Challenges Faced

- Impact on the Financial Industry

- Future Plans

- Conclusion

Biography of Jim Chanos

Jim Chanos is a name synonymous with short-selling in the financial world. Born in 1957, Chanos has spent decades refining his craft, becoming one of the most respected voices in the industry. Below is a brief overview of his life and career:

Early Life and Education

James Chanos was born in Milwaukee, Wisconsin. From an early age, he displayed a keen interest in finance and economics. After completing his high school education, Chanos attended Yale University, where he earned a degree in Political Science. His time at Yale laid the foundation for his future success, providing him with the analytical skills necessary to excel in the financial markets.

Key Facts About Jim Chanos

Here is a summary of key facts about Jim Chanos:

- Birth Year: 1957

- Place of Birth: Milwaukee, Wisconsin

- Education: Yale University (Political Science)

- Profession: Short-Seller, Founder of Kynikos Associates

Career Highlights

Chanos's career is marked by several significant milestones. After graduating from Yale, he began his career in finance, eventually founding Kynikos Associates in 1985. The firm specializes in short-selling, a strategy that involves betting against overvalued stocks. Over the years, Chanos has successfully identified several high-profile cases of corporate fraud, earning him a reputation as a financial detective.

Jim Chanos Net Worth

As of 2023, Jim Chanos's net worth is estimated to be around $1.5 billion. This figure is a testament to his skill as a short-seller and his ability to navigate the complexities of the financial markets. Chanos's wealth is primarily derived from his work at Kynikos Associates, where he has consistently delivered impressive returns for his investors.

Factors Contributing to His Net Worth

Several factors have contributed to Chanos's substantial net worth:

Read also:Julio Foolio Autopsy Unveiling The Truth Behind The Controversial Case

- Successful Short-Selling: Chanos has successfully identified and shorted several high-profile companies, including Enron and Valeant Pharmaceuticals.

- Long-Term Vision: His ability to predict market trends and identify undervalued stocks has set him apart from his peers.

- Strong Leadership: As the founder of Kynikos Associates, Chanos has built a team of skilled analysts who support his investment strategies.

Investment Strategy

Chanos's investment strategy is centered around short-selling, a practice that involves borrowing shares of a stock, selling them immediately, and repurchasing them at a lower price. This strategy requires a deep understanding of corporate finances and the ability to identify overvalued companies.

Key Components of His Strategy

Chanos's strategy is built on several key components:

- Rigorous Research: Chanos and his team conduct extensive research on companies, analyzing financial statements and industry trends.

- Identifying Fraud: One of Chanos's specialties is uncovering corporate fraud, a skill that has helped him avoid significant losses.

- Market Timing: Timing is crucial in short-selling, and Chanos excels at predicting market downturns.

Notable Achievements

Throughout his career, Chanos has achieved several notable milestones:

- Enron Scandal: Chanos was one of the first investors to expose Enron's fraudulent activities, earning him widespread recognition.

- Valeant Pharmaceuticals: He successfully shorted Valeant, predicting its downfall due to aggressive accounting practices.

- Industry Recognition: Chanos has received numerous awards for his contributions to the financial industry, including being named one of the "World's Greatest Investors" by Fortune magazine.

Challenges Faced

Despite his success, Chanos has faced several challenges throughout his career:

- Market Volatility: Short-selling is a high-risk strategy, and Chanos has experienced significant losses during market upswings.

- Regulatory Scrutiny: His work uncovering corporate fraud has sometimes drawn the attention of regulators, leading to increased scrutiny.

- Public Backlash: Short-sellers often face criticism from the public and media, but Chanos has remained steadfast in his approach.

Impact on the Financial Industry

Chanos's work has had a profound impact on the financial industry:

- Corporate Accountability: His efforts to expose corporate fraud have led to increased accountability and transparency in the financial world.

- Investor Education: Chanos has played a key role in educating investors about the importance of skepticism and thorough analysis.

- Market Stability: By identifying overvalued stocks, Chanos has contributed to market stability, helping to prevent bubbles and crashes.

Future Plans

Looking ahead, Chanos plans to continue refining his investment strategy, focusing on emerging markets and technological advancements. He remains committed to uncovering corporate fraud and educating the public about the intricacies of the financial markets.

Conclusion

Jim Chanos's career is a testament to the power of skepticism and rigorous analysis in the financial world. Through his work at Kynikos Associates, he has built a substantial net worth and earned a reputation as one of the most respected short-sellers in the industry. His contributions to corporate accountability and investor education have had a lasting impact on the financial world.

We invite you to share your thoughts and insights in the comments section below. For more articles on finance and investing, be sure to explore our other content. Thank you for reading!

Data Sources: Forbes, Bloomberg, Reuters.